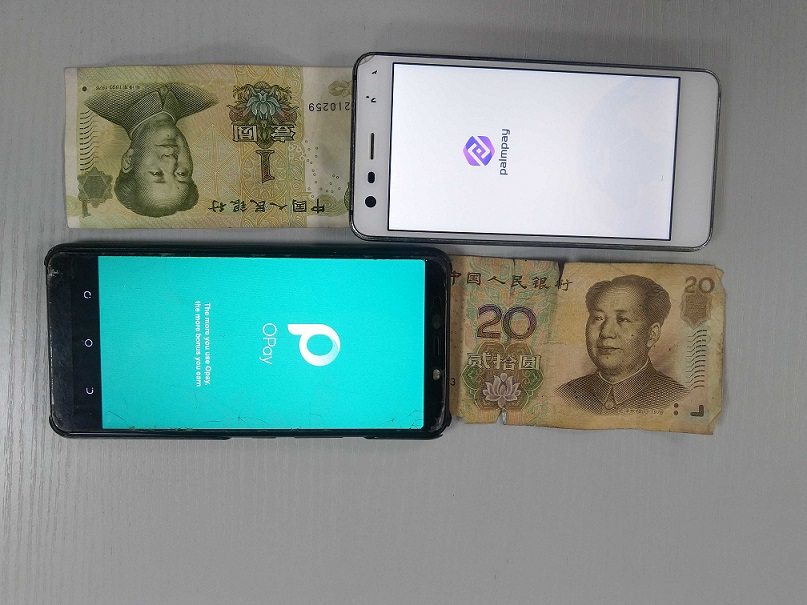

In Nigeria’s ever-evolving financial landscape, the leadership of the Point of Sale (PoS) market is firmly held by two Chinese-owned digital banking platforms: OPay and PalmPay.

These platforms have established a significant presence, boasting a collective total of over a million mobile banking agents, and have thus played a pivotal role in shaping the digital banking sector of the country.

OPay, a fintech company that emerged in 2018 through the acquisition of a local payment platform, has positioned itself as the frontrunner in this arena.

With an impressive count of 563,262 agents, as reported in the Nigeria Financial Services Report by Intelpoint, OPay has solidified its position as the undisputed leader.

Concurrently, PalmPay, the fintech subsidiary of Transsion Holdings, the manufacturer behind well-known smartphone brands like TECNO, Infinix, and itel, has also made remarkable strides.

A recent announcement showcased the expansion of its agent network to 500,000, marking PalmPay as a formidable contender in the PoS market.

What’s noteworthy is that when considering the broader scope of banking and mobile money agents, the cumulative count exceeds an astounding two million, as indicated by the 2023 State of the Industry Report on Mobile Money by the GSM Association.

This unequivocally positions OPay and PalmPay as significant players within the agency banking market, collectively contributing to at least 50 percent of its overall landscape.

The ascendancy of OPay and PalmPay to their commanding positions is underpinned by a multitude of factors, with financial backing being a primary catalyst, as indicated by industry experts.

Their financial prowess has empowered them to embark on ambitious expansion endeavors, not only within Nigeria but also across other African markets.

This has in turn empowered them to amass substantial market share and exert a tangible influence on the digital banking landscape.

Victor Olojo, the national president of the Association of Mobile Money and Banking Agents of Nigeria (AMMBAN), affirms this notion by stating,

“Their success can be attributed primarily to their financial strength. Leading players must boast robust resources.”

He points out that strategic investments from Chinese sources, coupled with successful fundraising initiatives, have paved the way for OPay and PalmPay to entrench themselves as frontrunners within the Nigerian market and beyond.

PalmPay’s journey to prominence is closely intertwined with its status as a subsidiary of Transsion Holdings.

In 2019, the holding company secured nearly $400 million through an initial public offering on China’s tech-focused stock exchange, Star Market.

This strategic move not only bolstered Transsion’s valuation but also positioned it as a prominent contender in the tech sector.

Remarkably, the substantial increase in share price since the IPO has further underscored its remarkable growth trajectory.

PalmPay’s financial journey includes a $40 million seed funding in 2019, followed by a substantial $100 million Series A funding round in August 2021, resulting in a total funding accumulation of $140 million.

Notably, Transsion Holdings played a pivotal role as the lead investor in both funding rounds, cementing PalmPay’s financial foundation and equipping it to pursue innovative strategies.

OPay, headquartered in Hong Kong, has emerged as a formidable force, amassing a staggering $570 million in funding, resulting in a valuation exceeding $2 billion.

Its Series C funding round in 2021, which raised $400 million, remains the largest funding injection for a fintech company primarily focusing on Nigeria and the broader African market.

The substantial financial backing has endowed OPay with the ability to diversify its product offerings and take calculated risks that some competitors might consider too audacious.

A pivotal aspect of OPay and PalmPay’s ascent to prominence lies in their approach, which emphasizes broad market presence and customer acquisition over transaction depth.

This strategic stance empowers them to invest in innovative ideas that resonate with a wider customer base, prioritizing expansion over sheer transactional volume.

In a rapidly evolving landscape where agility and adaptability are paramount, this approach has enabled them to explore uncharted avenues and identify what resonates best with their target audience.

The journey of these fintech giants has not been without strategic adaptations.

In the case of OPay, the company transitioned from operating as a super app offering diverse services, including ride-hailing and logistics, to focusing solely on fintech in 2020.

This shift played a pivotal role in securing the record-breaking $400 million Series C funding round in 2021, led by prominent investors such as Softbank Vision 2 Funds and Sequoia Capital China.

It’s evident that the presence and dominance of OPay and PalmPay bear significant implications for Nigeria’s financial ecosystem.

Their ambitious expansion strategies and commitment to innovation have not only reshaped the digital banking landscape but have also engendered healthy competition.

As they continue to onboard millions of customers, their investments inherently reduce the cost of client acquisition for smaller fintech firms, opening doors for heightened competition and propelling the industry toward greater innovation and customer-centricity.

Edoka Idoko, founder and CEO of OjirePrime, likens this trend to what traditional banks have experienced.

Just as banks onboarded millions of Nigerians previously underserved by financial services, these customers are now migrating to more nimble and innovative fintech platforms.

This transformative shift not only heralds a new era of financial inclusivity but also encourages all players to elevate their offerings and enhance customer experiences.

In conclusion, the ascent of OPay and PalmPay to prominence within Nigeria’s PoS market underscores their financial robustness, innovative strategies, and commitment to broad-based customer engagement.

These fintech giants have reshaped the landscape, sparking healthy competition and inspiring the entire industry to strive for elevated standards of customer experience and innovation.